Repayment Calculator Use our repayment calculator to work out your borrowing & repayments. |  Debt Calculator debt consolidation calculator to find out whether you can save money by consolidating your loans & credit cards |  Loan To Value Calculator This free online loan to value calculator will calculate your LTV and LTV Ratios. |

Knowing what your loan payments may be for consolidating your debts into a debt consolidation loan are important questions, First Choice Finance have a selection of calculators for you to use for illustration purposes, please note figures may vary depending on your individual circumstance for a more detailed illustration please contact one of our finance experts who will give you a no obligation free quote tailored for you.

Personal Loan Calculator - Calculate your monthly repayments for your personal loan, enter the interest rate, loan amount and loan term and you will receive your monthly payments as well as the full cost of the loan over the loan term. Personal Loans are usually between £1,000 and £10,000 over a term of 1 year up to 7 years

Secured Loan Calculator - If you are a home owner or mortgage payer and wish to borrow a larger amount or spread the payments over a longer period (terms range from 3 to 25 years), then a homeowner secured loan may be an alternative option. You can try different loan amounts with the loan repayment calculator, enter loan term, interest rate and loan amount then view the full payment details.

As well as loans First Choice Finance also offer an extensive selection of mortgages or remortgages and offer a selection of mortgage calculators

Mortgage Calculator Mortgage repayment calculator, to help you calcualte the cost of your mortgage or remortgage. |  Consolidation Calculator Find the cost of consolidating your debts into your mortgage |  Mortgage LTV Calculate your loan to value of your mortgage using are free online tool. |

Here at First Choice Finance we give you access to a selection of free loan and mortgage calculators and tools to help you structure your finances, loan calculators include a loan repayment calculator, debt consolidation loan calculator and a credit profile tool

If you want a more personalised view simply complete our simple online loan application form and you will be contacted by one of our loan experts who will search for the best loan plan from our panel of lenders to find the best loan deal to suit your needs, all loan quotes are provided FREE.

£25,000 Loan Example

If you borrow £25,000 over 15 years at an APR of 17.9% you will end up repaying £400.81 per month, total payable £72,145.80. It is important to remember the loan rate you receive will depend on your individual circumstances, extending the loan term will reduce your monthly repayments but will increase the total amount repayable over the term of the loan, early repayment of the loan will decrease the total cost of the loan

|

|

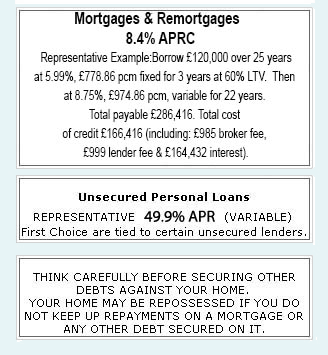

Unsecured Personal Loans |

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST

YOUR HOME. |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential